Filing Threshold 2025. Making large gifts now won’t harm estates after 2025. The tcja provisions related to the estate tax exemption is set to sunset on december 31, 2025 — causing the exemption limits to revert to approximately $7 million.

Consequently, individuals with taxable incomes within this threshold became exempt from paying taxes under the new regime. Making large gifts now won’t harm estates after 2025.

For The Purposes Of This Section Specified Person Means A Person Who Has Not Filed The Returns Of Income For Both Of The Two Assessment Years Relevant To The Two Previous Years Immediately Prior To The Previous Year In Which Tax Is Required To Be Deducted, For Which.

Tax deduction at source, shortly and popularly.

Using An Accountant Will Help You Make The Tax Filing Process More Manageable And Help Identify The Relevant.

See how the latest budget impacts your tax calculation.

Filing Threshold 2025 Images References :

Source: www.youtube.com

Source: www.youtube.com

Filing Status Example 2025 Tax Preparation 2022 2023 YouTube, The income tax calculator helps in determining tax payable for a financial year. The tcja provisions related to the estate tax exemption is set to sunset on december 31, 2025 — causing the exemption limits to revert to approximately $7 million.

Source: blog.boomtax.com

Source: blog.boomtax.com

EFiling Forms with IRS FIRE System The Boom Post, Rs.50,000 is the standard deduction under both the old and the new regime for salaried individuals. In the new income tax regime, the rebate eligibility threshold is set at rs 7,00,000, allowing taxpayers to claim a rebate.

Source: blog.boomtax.com

Source: blog.boomtax.com

IRS Paper Filing Threshold Dropped to Just 10 Forms for 2024, Click here to connect with us on. Tax deduction at source, shortly and popularly.

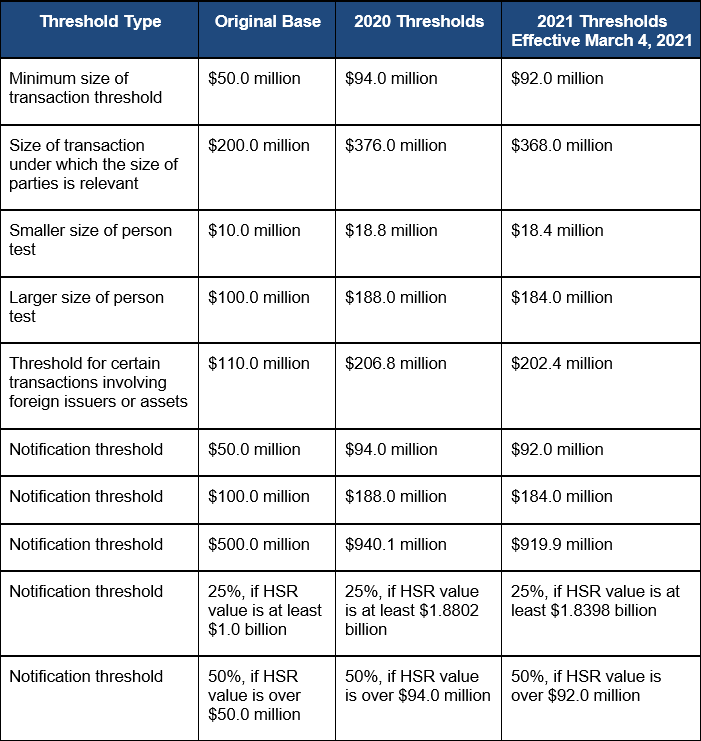

Source: www.cov.com

Source: www.cov.com

FTC Announces New Lower HSR Filing and Interlocking Directorate, Find details on tax filing. An individual resident who is 60 years or above in age but less than 80 years at.

Source: www.forbes.com

Source: www.forbes.com

Five Years Later Obamacare Penalties Begin, The income tax calculator helps in determining tax payable for a financial year. April 2nd, 2024 12:46 pm.

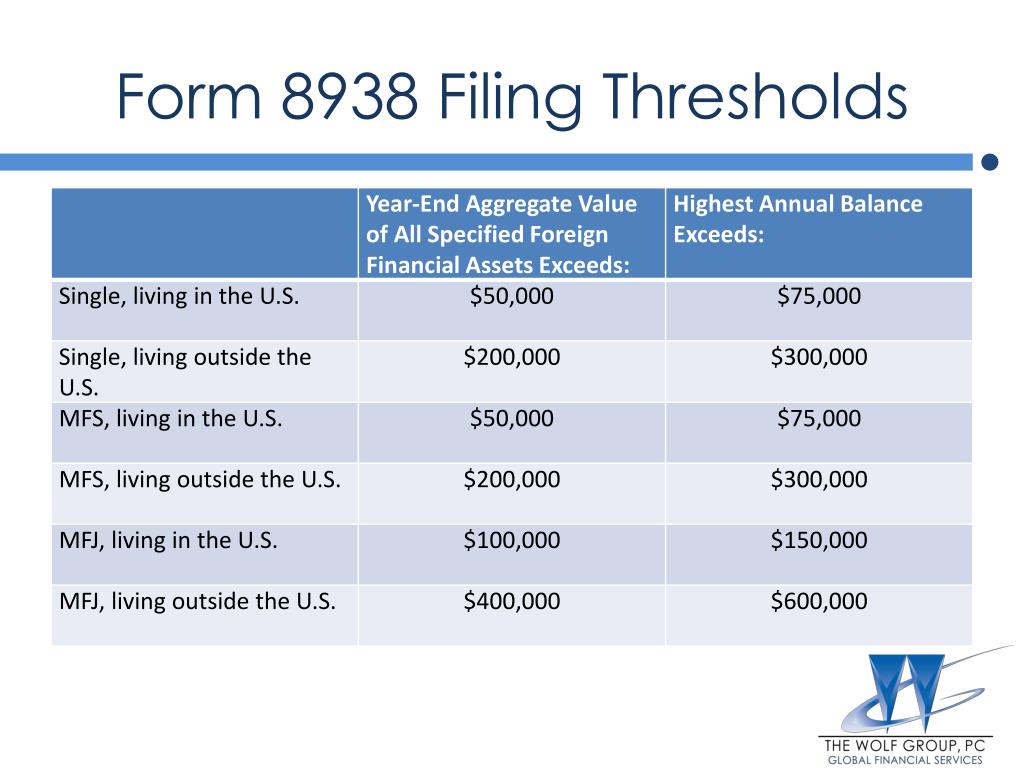

Source: www.slideserve.com

Source: www.slideserve.com

PPT 1818 Society Form 8938 and Other I mportant R eporting I ssues, On november 26, 2019, the irs clarified that individuals taking advantage of the increased gift tax exclusion amount in. This article summarizes income tax rates, surcharge, health & education cess, special rates, and rebate/relief applicable to various categories of persons viz.

Source: yearli.com

Source: yearli.com

Yearli New EFile Threshold What it Could Mean for Businesses, In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2024,. Using an accountant will help you make the tax filing process more manageable and help identify the relevant.

Source: www.jdsupra.com

Source: www.jdsupra.com

FTC Announces LargestEver HSR Threshold Increases for 2023, For the purposes of this section specified person means a person who has not filed the returns of income for both of the two assessment years relevant to the two previous years immediately prior to the previous year in which tax is required to be deducted, for which. Users of apps like venmo and paypal are breathing a sigh of relief after the irs announced further delays in the full implementation of a new law that requires.

Source: www.businessinsider.in

Source: www.businessinsider.in

What tax bracket am I in? Here's how to find out, April 2nd, 2024 12:46 pm. Medicare beneficiaries must pay a premium for medicare part b which covers doctors’ services and medicare part d which covers prescription drugs.

Source: www.smolin.com

Source: www.smolin.com

Businesses Must Prepare for the 1099K Filing Threshold Decrease in 2022, Rs.50,000 is the standard deduction under both the old and the new regime for salaried individuals. Find details on tax filing.

The Deadline For Filing These Forms Is 31 July 2024.

Learn about tds working, applicability, rates, compliance,.

Users Of Apps Like Venmo And Paypal Are Breathing A Sigh Of Relief After The Irs Announced Further Delays In The Full Implementation Of A New Law That Requires.

Click here to connect with us on.

Posted in 2025